Imagine an insurance company that autonomously monitors customer needs, analyzes risk, flags fraud, processes claim approvals, and updates policies—all without waiting for human prompts. That’s the bold future Agentic AI is unlocking.

What Is Agentic AI?

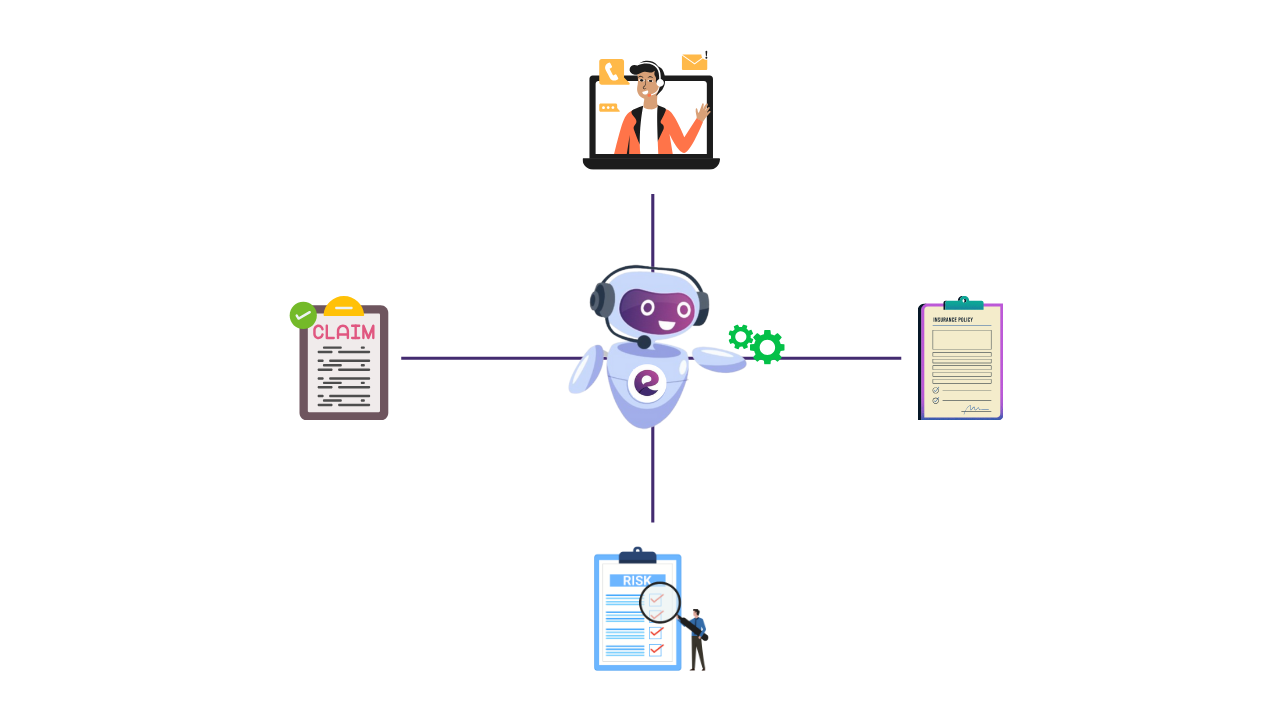

Agentic AI isn’t your typical chatbot or voicebot—it’s a highly autonomous system that can think, predict, plan, and make decisions on its own, continuously learning and coordinating across CX workflows

Gartner predicts that although less than 1% of enterprise software contained Agentic AI in 2024, by 2028 those systems will power 15% of daily work decisions and be embedded in one-third of enterprise applications

The Insurance Imperative: Why Now?

The insurance industry has been talking about digital transformation for years—but customer expectations are no longer waiting. Policyholders now demand real-time updates, personalized support, and seamless experiences across every channel. At the same time, insurers face rising claims costs, stricter regulations, and a pressing need to streamline their operations.

This combination of shifting customer demands and operational pressure has created a tipping point. Traditional tools and incremental process improvements are no longer enough. What’s needed is a new way of working—where intelligence is embedded into every interaction, every decision, and every system.

That’s where Agentic AI comes in: not just as another efficiency play, but as a fundamental rethinking of how insurers engage with customers and manage risk.

Agentic AI in Action: The Self-Managing Insurer

Here’s how Agentic AI is rewriting insurance operations:

- Autonomous Claims Handling: AI assesses claim data, validates coverage, and can settle straightforward cases independently—escalating only as needed.

- Proactive Risk Mitigation: Automatically monitors risk signals—from weather to usage—and nudges customers toward safer behaviors or updated coverage.

- Fraud Intelligence: Detects suspicious patterns and initiates investigations before payouts occur.

- Adaptive Underwriting & Pricing: Continuously refines risk profiles and dynamically adjusts premiums based on behavior, sensor data, and external events.

- Backend Orchestration: Legacy systems, APIs, and microservices collaborate seamlessly—sharing data, executing decisions, and balancing load even during demand spikes.

The Cautionary Lens

Of course, this transformation isn’t risk-free. Gartner warns that over 40% of Agentic AI projects may be canceled by 2027 due to unclear ROI, vendor overpromising (“agent washing”), or weak implementation strategies. Success lies in starting small, tracking real-world outcomes, and building with safeguards.

Charting the Path Forward

To become a self-managing insurer, companies must focus on:

- Clear Use Cases: Start with high-impact, well-defined applications (claims triage, fraud detection).

- Robust Data Infrastructure & Governance: Deploy AI responsibly with transparency, oversight, and auditability

- Iterative Learning: Measure performance not just technically, but including customer trust and operational impact

- Human-in-the-loop Design: Ensure agents act under well-defined guardrails with human oversight where stakes are high.

Final Word

This isn’t sci-fi—it’s already happening. Agentic AI is powering self-managing insurance operations, improving accuracy, speed, and customer trust while reshaping back-office dynamics. Those insurers who embrace this shift now will be the ones driving tomorrow’s competitive edge.

Explore how Engagely.ai is enabling insurers to turn that future into reality—with Agentic AI systems that orchestrate workflows, anticipate needs, and supercharge customer engagement.

Engagely marketing