Proud to be associated with

AI In Banking May Be The Next Big Differentiator

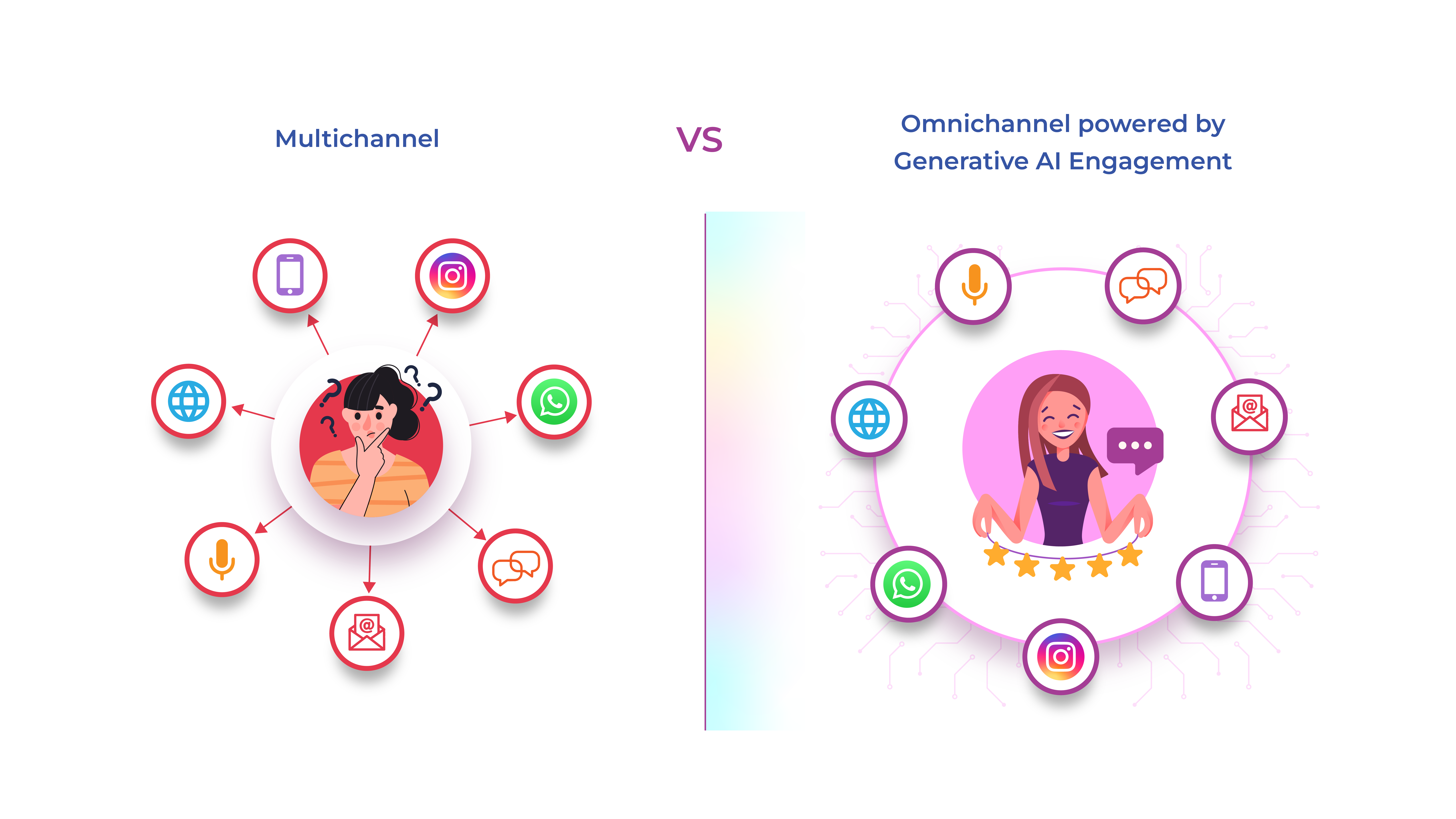

As banking becomes more digital, banking revolves around deep products, processes and systems understanding. Engaging customers with complete control of all these three is a machine scale problem which Engagely is solving. With this as the foundation of the platform, Engagely develops deep customer intelligence to drive personalized engagements across modern enterprise channels and global languages and thereby makes AI banking on-demand, intuitive and immersive with delightful customer support and experiences.

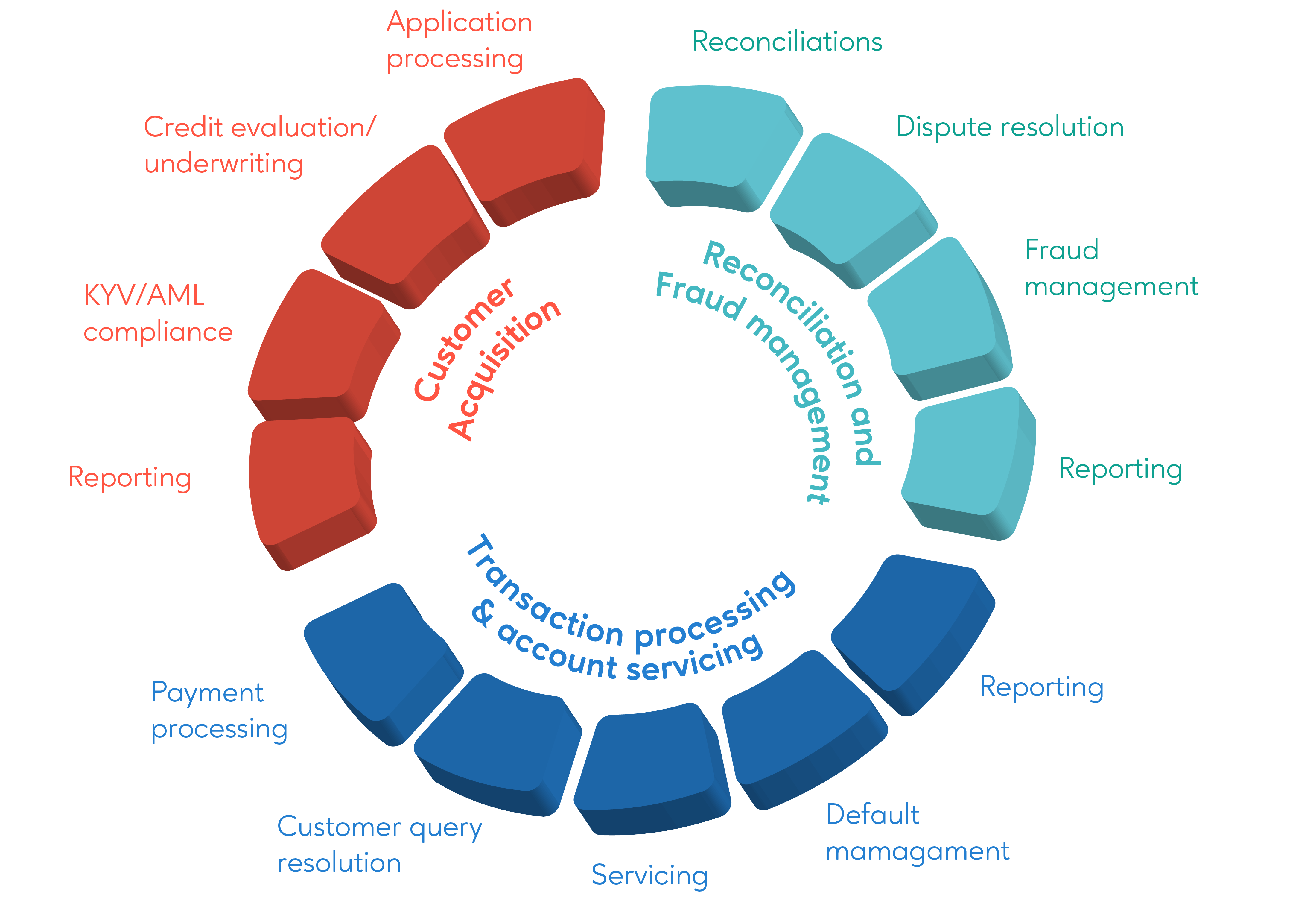

From acquisition to servicing to support, experience the cutting edge CX transformation

25-30%

Improved agent productivity

80%

Automation of support queries

20-30%

Improvement in NPS

25%

Improved upsell & cross-sell revenue

Engagely.ai is pushing the boundaries of banking CX with enterprise grade AI automation

Modernize & simplify end-to-end complex banking operations with AI automation

Automated Complex Banking Operations

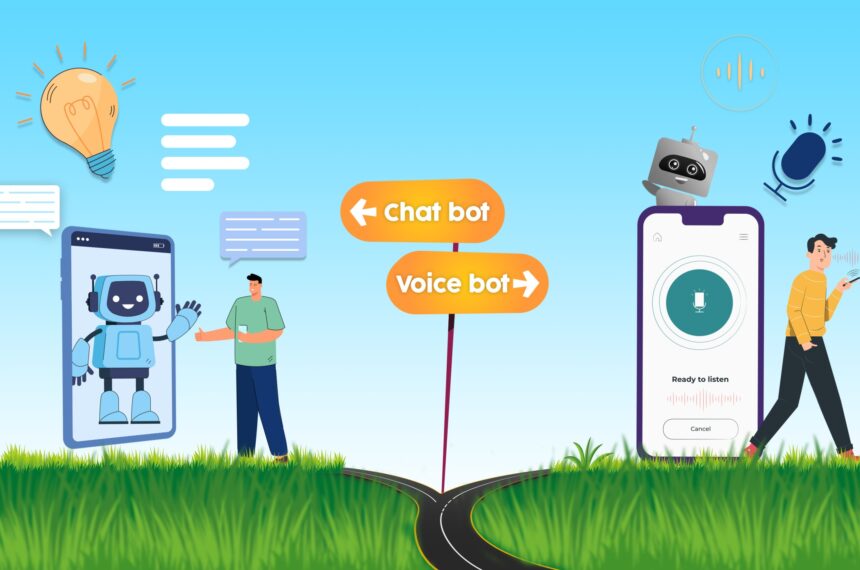

From account opening to making transactions to applying for credit cards, automate operations with ease by leveraging voice AI and banking chatbot.

Smart Payment Processing

AI automation allows customers to make hassle-free payments with a few clicks by leveraging multi-layered data protection and banking grade security.

Simultaneous Query Handling

The AI automation imbues banking systems with a tremendous capacity of multiple call & queries handling.

Expand Your Banking Outreach

Conduct seamless engagements in 35+ channels & 120+ languages to reach out vast geographies effortlessly.

Reviews And Feedback

Banks can easily customize their own bots for collecting customer feedbacks and reviews while simplifying the process for customers as well.

Lead Generation And Customer Acquisition

AI banking in place can help you seamlessly acquire leads with a tailor-made approach to connect with customers and deliver highly personalized engagements.

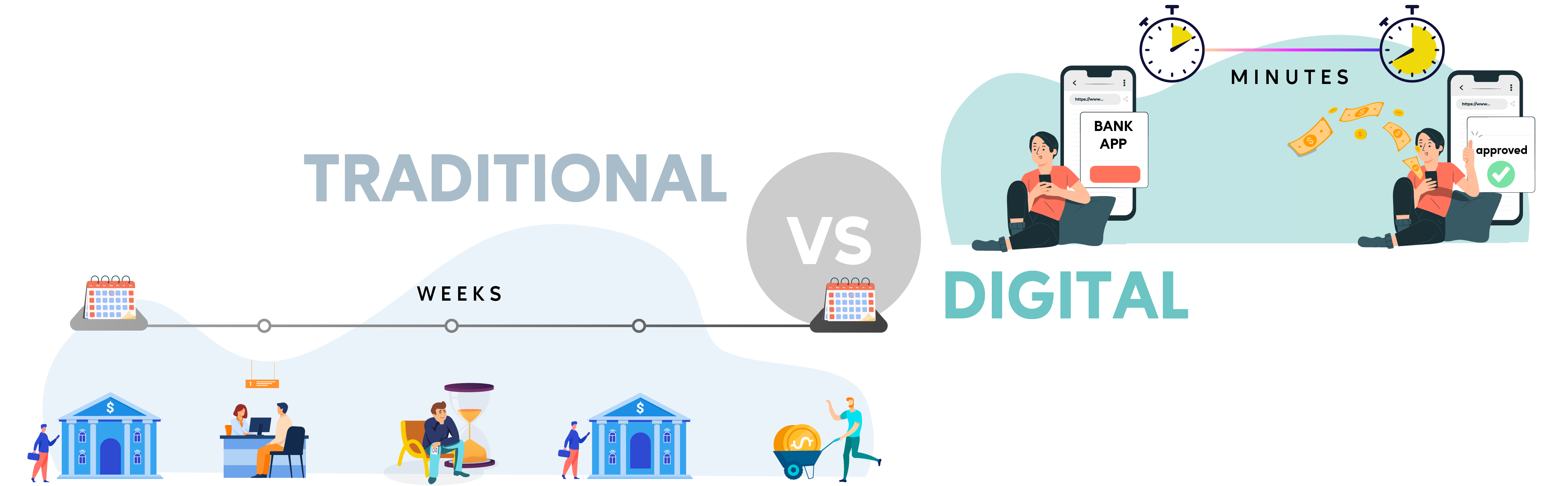

Optimal operational efficiency and profitability for retail banking

Engagely.ai helps accelerate the efficiency of retail bank processing by going beyond brick-and-mortar branches and legacy processing systems. The intelligent automation can help significantly boost customer experience, reduce operational cost, and enhance compliance across the core processes in the retail banking value chain.

Automating day to day conversational banking operations like opening CASA, applying for cards and loans, deposits, payments, transfers, recharges, service requests, and lead generation process can help your teams spend more time on strategic tasks.

Business banking is well placed to take advantage of AI automation

The rich analytics and In-depth insights with detailed customer profiles in a unified window helps you recommend new and optimized product portfolios to your customers. This also drives acquisition and great control over retention of customers, as well as cross and up-selling.

Automate Complex Banking Operations

Automate loan advisory, mortgage applications, approvals processes and more to expedite processes by adding unmatched pace to the data processing and accuracy.

Customer Support

Drive streamlined omnichannel customer support at scale across channels. Achieve increased customer satisfaction score (CSAT) with improved average handling time (AHT).

Lead Generation

Seamlessly convert every casual enquiry into a meaningful lead. Provide right nudges for the financial services to the customers based on their needs and requirements.

Lending, Payment & Transaction Analysis

Engagely voice AI and banking chatbot minimizes manual efforts by automating processes to conduct accurate risk assessment of an individual or SMEs.

Sales Analysis

With custom dashboards and customizable data categorization, automate sales analysis reports to generate personalized and on-demand analytics.

Engagely.ai’s all in one AI suite- specially crafted solution for banking needs

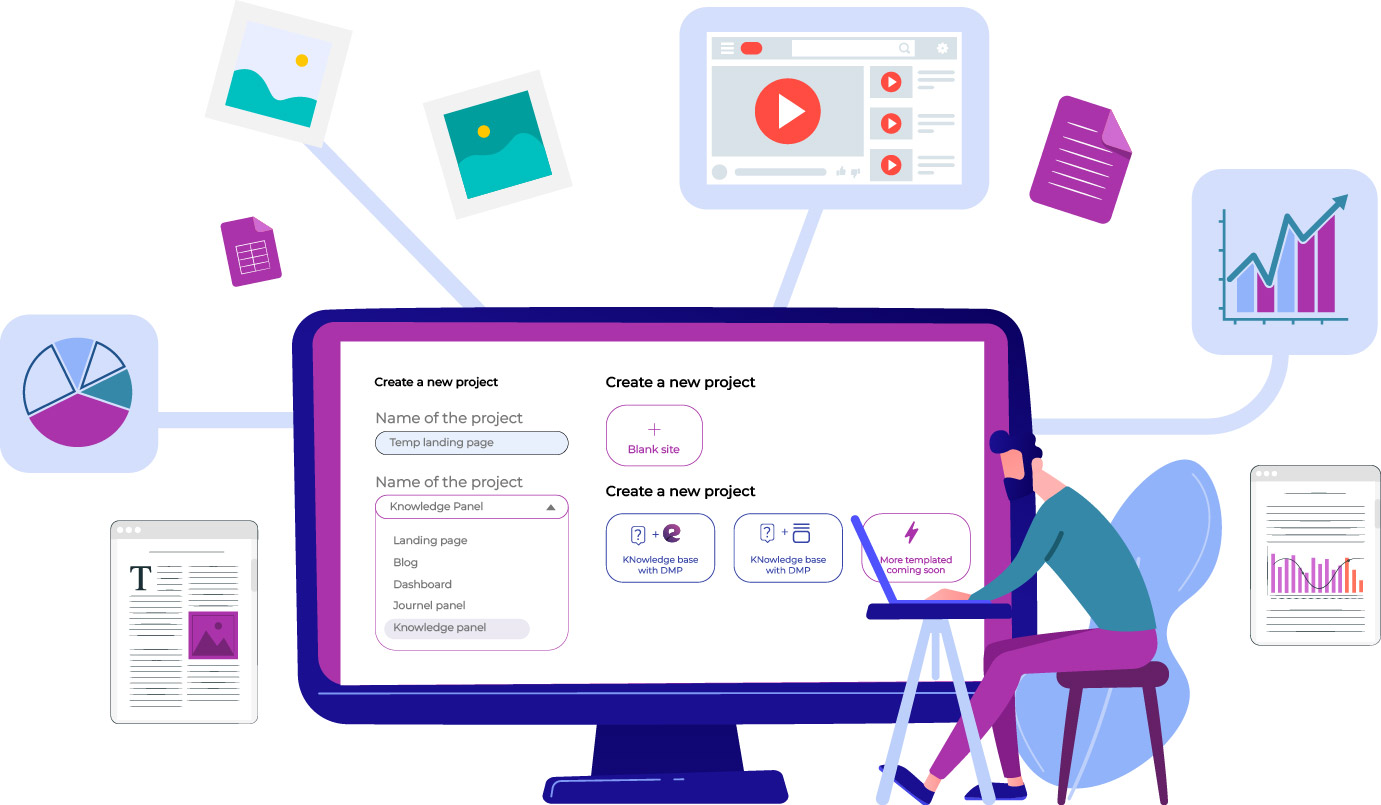

Engagely Automation Cloud

Automate banking support and CX workflows to drive personalized, results-oriented conversations across voice, email and chat with Engagely voice-first AI suit. Empowered with advanced NLP, these banking bots are more than capable of handling even complex support queries. Furthermore, they are supremely vigilant to tackle all kinds of queries with great care and precision.

Learn More

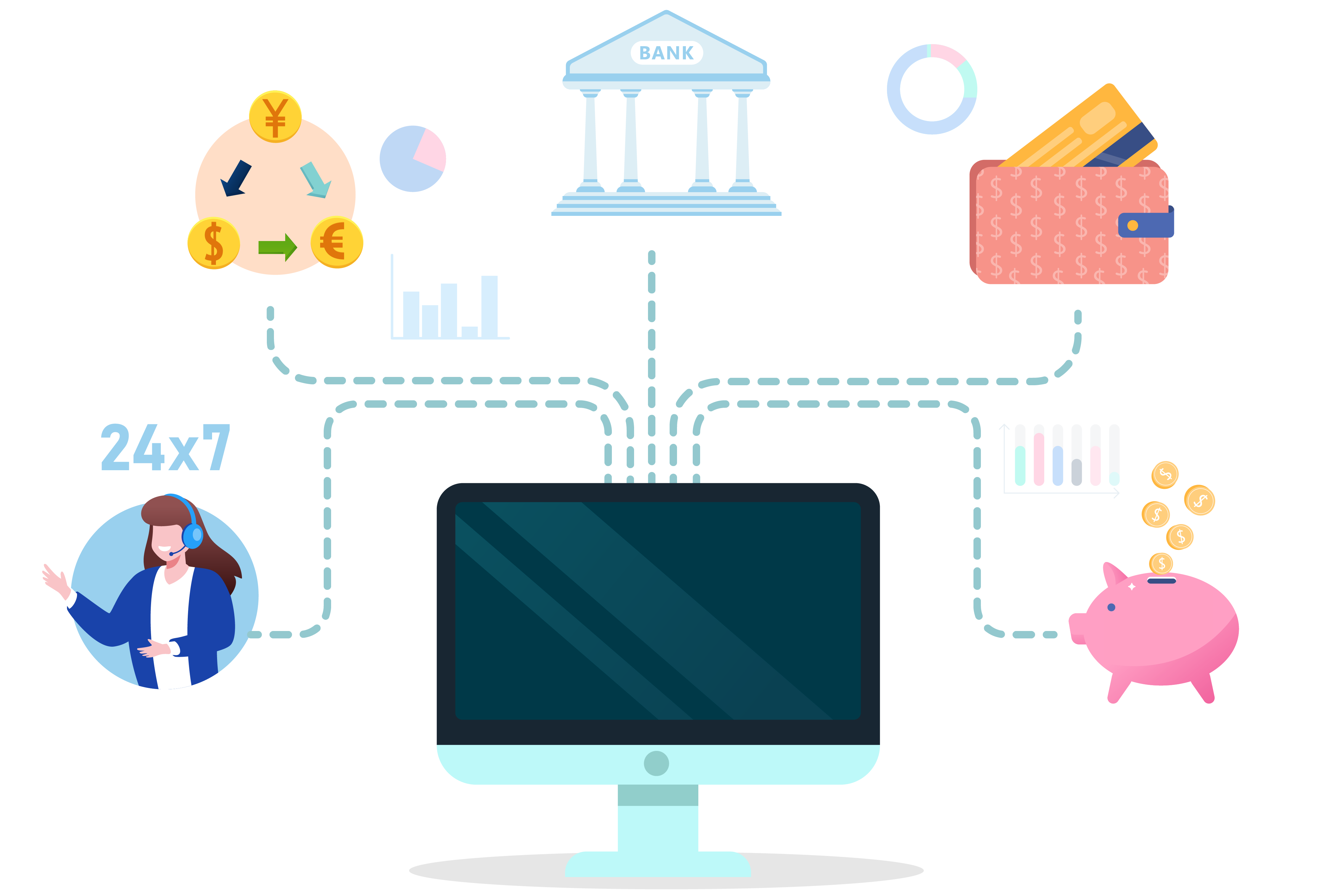

Unified Communication Cloud

The transformative unified communication cloud is just a perfect solution to drive on demand 24*7*365 support across time zones, languages and modern enterprise channels for your banking customers. It includes but is not limited to agent assist, customer 360 degree view, data intelligence, live chat software, email ticketing, and behavioral analytics.

Learn More

Engagely Analytics Cloud

Glean deep insights from the customer data like their spent analysis, customer portfolio, and segmentation analysis using AI driven analytics cloud to deduce meaningful data. This further helps to promote or tone down new offers or resolving queries with suitable responses based on customer behavioral patterns.

Learn More

Precision. Higher Efficiency. Improved Customer Satisfaction.

Ready To Use Banking AI models

Easy Integrations With Existing CRM System

Faster Deployment With No-Code

Omnichannel Presence

Multilingual Support

Secure sensitive data with AI based automation driven data security

Industry Grade Security Against Theft Of PII

24/7 Risk Monitoring

Real-Time User Activity Tracking

Voice Recognition For Prevention Of Identity Theft

Constant Data Pattern Analysis

Enhancing customer support and engagement in 35+ channels across text and voice

Latest from our blogs

Our success in transforming banking operations

Transforming merchant/distribution partners engagement using Conversational AI

The first payments bank to go live with 410 branches and more than 25,000 banking points on day one....

Conversational AI To enhance Agent Training & Productivity

Client is one of India's leading banking and financial services groups, offering a wide range of financial services that encompass every sphere of life....